Did you know the #1 natural disaster are hurricanes? Due to the fact that natural disasters are unavoidable, choosing the right coverage for your business is essential. When choosing the right coverage for your specific business reading and understating your policy is imperative to your company’s success.

The strike of Hurricane Sandy sadly devastated many businesses in 2012. Hurricane Sandy’s damages were tremendous enough to close businesses for days, shut down businesses permanently, along with having massive amounts of damage to the property, only to find out they didn’t have the proper coverage according to CNN. Hurricane Katrina still lingers in the neighborhoods of New Orleans, ten years after, leaving houses vacant and falling apart. Hurricanes of that size can put small businesses out of business for good with lack of proper insurance. In 2014, the U.S. had 6 hurricanes, not including tropical storms.

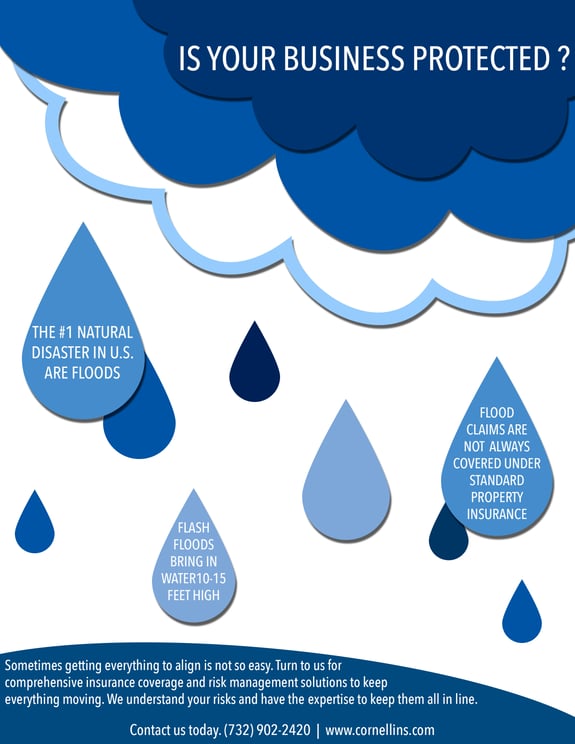

Hurricanes and tropical storms aren’t the only causes of flooding. Most companies overlook snowmelt and winter storms as threats and are quite common. Flash floods can bring walls of water 10-15 feet high in some areas. However, what people fail to realize is 20% of flood claims come from moderate-to-low risk areas. Is your company protected if flooding were to occur?

Proper flood insurance for your company is imperative for your business’ success. Many people simply overlook flood insurance, thinking it is already covered under property insurance. Commercial flood insurance takes 30 days for the policy to take effect. It's important to buy your insurance before the storm approaches.